The majority of employees are concerned about CEO compensation patterns. Every dollar that goes to a CEO is a dollar that does not go to them or anyone else. People appear to take issue when the CEO earns significantly more than the typical worker. The point isn't that CEOs don't deserve to be the highest-paid employees in any given company; the CEO's pay is much higher than that of average employees, who are also important contributors. This article will go over all there is to know about CEO compensation ratios. We will discuss how CEOs are compensated and the current trends regarding CEOs' pay ratios.

Exorbitant CEO pay is one of the key causes of rising inequality that we could safely eliminate. CEOs worldwide are getting paid more, so much of their income (more than 80%) is based on stock performance, not because they increase their productivity. This increase in CEO salary, as well as executive compensation in general, has propelled the expansion of the top 1% and 0.1% of incomes, leaving less of the rewards of economic growth for regular employees and widening the income gap between the top 1% and the bottom 90%.

The CEO pay ratio compares the overall compensation of the CEO to that of the typical employee. The CEO pay ratio is computed by dividing the CEO's remuneration by the median employee's remuneration. The CEO pay ratio allows boards to analyze how their company's pay ratio compares to similar companies and whether there have been any significant changes from past years.

The CEO-to-worker pay ratio is significant because a greater pay ratio could indicate that organizations have a winner-take-all culture where CEOs receive the lion's share of income. A smaller pay ratio could reflect the organization's committed equity.

The ratio of CEO to typical worker compensation is estimated at 351-to-1 in 2020, up from 307-to-1 in 2019, and a significant increase from 21-to-1 in 1965 and 61-to-1 in 1989. CEOs earn over six times as much as other extremely high earners (those in the top 0.1 percent of the workforce).

Calculating CEO Pay Ratios

There are essentially five steps in determining the CEO pay ratio, which includes:

1. Calculate the CEO's salary for the current fiscal year. Salary, annual bonus, incentive, and benefits are all included in the overall pay.

2. Determine which employees are covered, including full-time, part-time, and temporary workers. Independent contractors should not be included in the category.

3. Calculate the median employee wage for the employees in the group.

4. Calculate the median employee compensation for the fiscal year in question.

5. Divide the CEO compensation by the median employee pay to get the CEO pay ratio.

NOTE: Stay informed about the ever-changing landscape of CEO appointments! Our robust CEO Appointments Tracker offers a wealth of data-driven insights you won't want to miss

Growth of CEO Compensation during the Pandemic

The enormous increase in CEO pay during the pandemic is astounding. While millions of people were out of work, CEO's total compensation increased by 18.9% in just one year. Typical worker compensation increased by 3.9% in that year for those who stayed employed—and even that salary gain is exaggerated: Inversely, the high rate of job loss among low-paid workers pushed up the average salary.

What Are the Effects of CEO Pay Ratios on Employees and Shareholders?

The influence of CEO pay ratio disclosure on the board of directors, shareholders, and employees is significant.

The Effect of the CEO Pay Ratio on Shareholders

The majority of shareholders agree that executive pay packages for CEOs are a good idea. According to the Russell 3000s 2018 Say on Pay and Proxy Results, 97.4 percent of businesses that had a Say on Pay ballot in 2018 received a positive vote from shareholders. According to the research, 1,611 of the 1,909 companies revealed their CEO pay ratio to their shareholders. In 2018, the CEO pay ratio had no substantial impact on the Say on Pay vote. It's too early to say whether pay ratio disclosures would have any impact on stock prices.

CEO Pay Ratio Impact on Board of Directors

The remuneration committees of boards that delegate remuneration considerations to a committee will need to evaluate many things. Most remuneration committees have focused primarily on the CEO's compensation package when determining executive remuneration. Remuneration committees must now ascertain who their median employees are and how much they are paid under the new transparency guidelines.

First and foremost, compensation committees must assess how their CEO pay ratios and median staff pay rates are comparable to those at similar organizations. Second, when committee members get the numbers for the CEO pay ratio and median employee compensation, they must evaluate the possible reaction from employees. Employee morale may suffer due to the outcomes, so the board of directors must explain the pay ratio and be prepared to deal with any moral issues that arise. Third, the board of directors should evaluate the potential impact on the company's reputation of CEO pay ratio disclosures. Finally, boards must be aware of CEO compensation ratios that differ significantly from previous years. It's critical to consider why ratios were greater or smaller and how those changes impacted median employee compensation. They'll also need to analyze how their modifications over time compare to changes at other organizations.

CEO Pay Ratio Impact on Employees

Pay rate debates in public can negatively impact a company's culture and lower employee morale. Employees will be surprised by the disclosure of CEO compensation ratios. Nobody is surprised to learn that their income is significantly lower than the median market salary or paid considerably less than if they worked for a rival.

Employees may eventually put pressure on employers to raise salaries due to the disclosures. Employees are more inclined to ask for greater compensation if they have more knowledge. To keep staff happy and reduce turnover, employee salaries may need to be gradually adjusted by boards.

How much should a CEO be paid as a percentage of revenue?

CEOs earn a lot of money since they are the company's highest-paid employees. The skills and responsibilities required of a CEO are extensive, and the number of persons qualified to occupy these positions is limited. As a result, the market has judged that persons with these abilities are valuable. Only approximately 20% of a CEO'sCEO's pay should be based on base income; the rest should be based on performance-based incentives. The logic is that if the firm is doing well and the shareholders are profiting, then the CEO should benefit from it.

CEO pay varies greatly depending on the circumstances. It is determined by various criteria, including the industry, company stage, company size, profitability, ownership type, and the company's competitive position in the talent market.

What is the pay-to-performance rule?

The Pay Ratio Rule allows a business to identify its median employee by employing a consistent compensation measure, such as data from internal tax or payroll records.

Trends in CEO pay ratios

The pay ratio is used to prove that CEO compensation packages are exaggerated and raise concerns about income inequality.

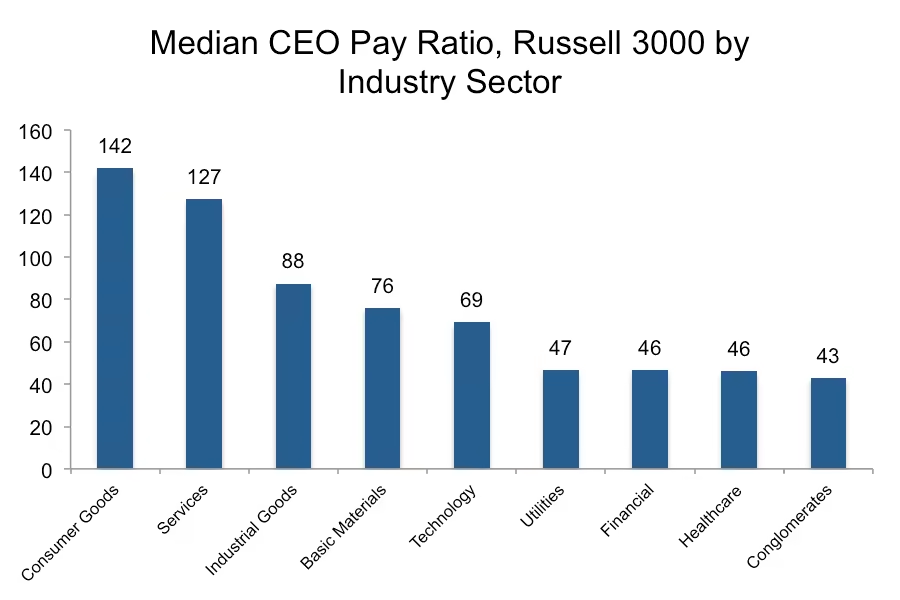

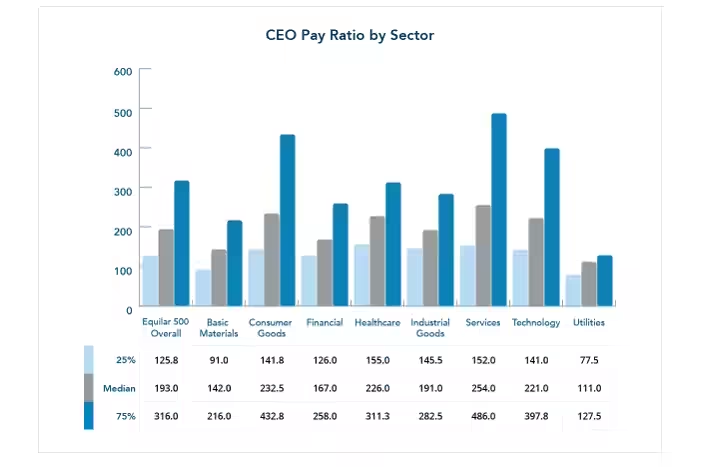

The Equilar CEO Pay Ratio Tracker collects data on the lowest, median, and highest CEO pay ratios every week and offers cumulative statistics. As of May 10, 2018, the median pay ratio for all Russell 3000 businesses was 70:1 and 166:1 for all Equilar 500 companies, based on over 2,000 data points.

CEO Pay Ratio by Company Size

Company size also tells a different story for the CEO pay ratio.

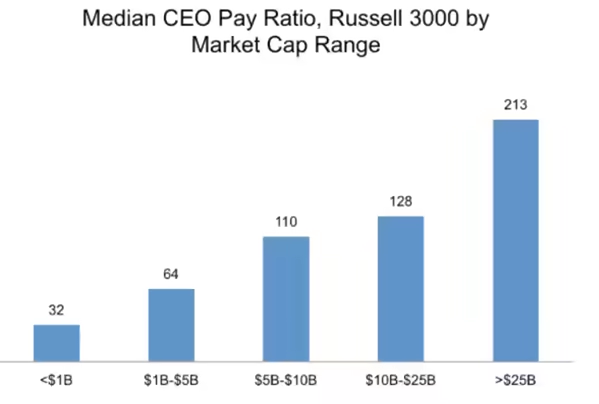

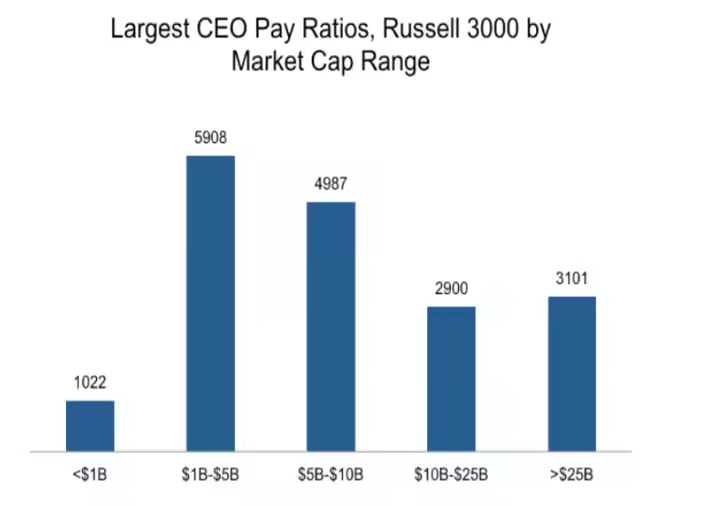

When looking at CEO pay ratios based on market capitalization, the median CEO pay ratio grew as the company's market capitalization climbed. The median ratio for firms with a market capitalization of more than $25 billion was 213:1, compared to 32:1 for companies with a market capitalization of less than $1 billion.

According to the market capitalization analysis, as the number of employees at a company grew, median employee pay decreased, and the ratio climbed. The median employee compensation across all Russell 3000 businesses was $64,024, with organizations with 1,000 to 5,000 employees paying the most. Employee remuneration was around $50,000 for organizations with more than 10,000 employees. Because CEOs of large companies earn more on average, the CEO pay ratio increases in organizations with more employees.

Companies in the utilities, basic materials, and financial sectors rank below the Equilar 500 median pay ratio. These companies also have the lowest median employee counts. Predictably, larger firms will be impacted the most by any compensation legislation based on the CEO pay ratio due to a combination of more employees and a more demanding occupation for chief executives. High median pay ratios in sectors like services, consumer goods, and healthcare rank above the median employee counts. Since employee count is a good proxy for company size industries that, require more employees than others will tend to have high pay ratios even if their CEO pay is in line with current norms.

Benjamin Sombi is a Data Scientist, Business Analytics Manager at Industrial Psychology Consultants (Pvt) Ltd a management and human resources consulting firm.