Introduction

Industrial Psychology Consultants conducted a cost of living survey for all employee level categories. The data is provided to the reader in the form of averages, except for the total cost of employment, with numbers presented as the median. Using averages is possible for both continuous and discontinuous sets of numerical data. Unless otherwise specified, all expenditures are shown as regular monthly outlays denominated in Zimbabwe dollars (ZWL$).

The cost of living is the amount of money needed to sustain a certain standard of living by affording basic expenses such as housing, food, and healthcare. The cost of living is often used to compare how expensive it is to live in one city compared to the other. In everyday situations, salaries and wages are related to the general cost of living.

This report can be used to start discussions on solutions to the disparities between the cost of living and employee earnings.

There is increased demand for companies to raise wages and salaries due to the rising cost of living. Undoubtedly, the rising cost of living is impacting employees across the board. No employer is safe from this. There has been a lot of pay bargaining among national employment councils. A few of them have already factored in the USD component.

The key question is, can employers afford to match inflation as they adjust salaries. The answer will depend on each organization's circumstances, as affordability and sustainability will be key.

Summary of Key Findings

- The cost of living in Zimbabwe has been increasing exponentially since 2020.

- Based on the survey results, most Zimbabwe employees can't afford to save money for retirement and emergencies.

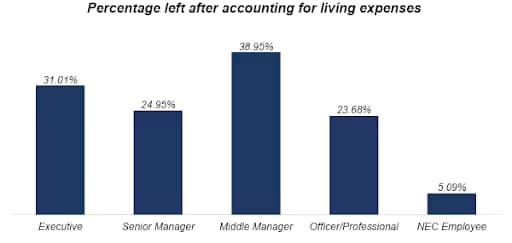

- On average, employees are left with 24.7% of net income after accounting for living expenses.

- The worse affected groups are the Officer/Professional level, Senior Manager, and NEC staff.

- For the NEC employees, a large part of their earnings goes to food and rentals.

- A large part of the earnings for Officer/Professional level employees goes to rent and food.

- For the Senior Managers, a large part of the earnings goes to rent and school fees.

- To alleviate the suffering of NEC levels staff, it may assist if employers offer food hampers and adjust housing allowances in line with prevailing market rentals.

- To alleviate the earnings mismatch at Officer/Professional level, any assistance with rentals, school fees, and food would go a long way.

- For senior managers, any assistance with rentals and school fees would assist them in covering the gap between earnings and living expenses.

- Employees earning in Zimbabwe dollars will have to be content with the exchange rate depreciation and inflation.

- On the one hand, employers will have to assess if they can afford to adjust salaries to match inflation and exchange rate depreciation. A tall order for most businesses.

- To retain the purchasing power of employees' salaries, employers would need to match inflation or pay a portion of the salaries in US dollars which some employers already do.

- The revenue mix of the organizations would determine whether they can pay salaries in US dollars.

The use of this report is permissible on the condition that you reference this source and link to this report.

By downloading this resource, you agree to our privacy policy and terms of service.