Checks may seem old-fashioned, but they still play a role in banking, payroll, and certain financial transactions. Two terms often cause confusion voided checks and cancelled checks. They sound similar but serve very different purposes. Knowing the difference can save time, prevent mistakes, and make financial tasks like setting up direct deposit much smoother. For those who don’t have a paper checkbook handy, tools like an online voided check generator can also simplify the process.

What Is a Voided Check?

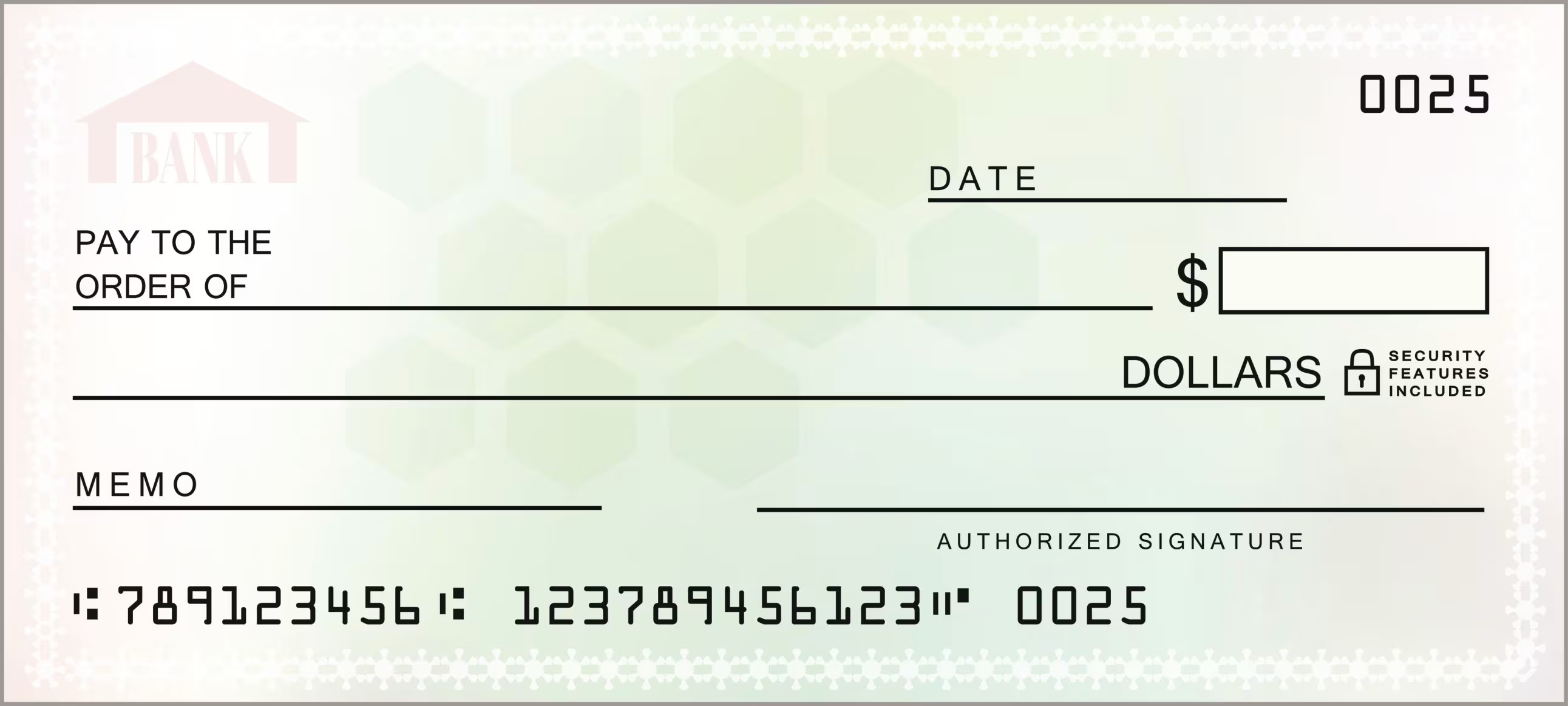

A voided check is simply a check that has “VOID” written across the front in large letters. Once marked, it cannot be used to withdraw or transfer money. Instead, its purpose is informational.

Businesses and individuals often request voided checks to obtain banking details such as:

● Account number.

● Routing number.

● Bank name.

Common uses for voided checks include:

● Setting up direct deposit for payroll.

● Authorising automatic bill payments.

● Linking a checking account to investment or loan services.

Because the word “VOID” cancels the negotiable power of the check, it becomes safe to hand over without risk of someone cashing it.

What Is a Cancelled Check?

A cancelled check is different. It refers to a check that has already been processed by a bank. Once a check clears meaning funds have been withdrawn from the payer’s account and delivered to the payee it is stamped or marked as cancelled.

Cancelled checks act as proof of payment. For example:

- A tenant can use a cancelled rent check to prove payment to a landlord.

- A business may present cancelled checks during audits or tax preparation.

- Individuals may use them as evidence for resolving disputes with service providers.

Unlike voided checks, which are provided before money moves, cancelled checks show that money has already moved.

Key Differences Between Voided and Cancelled Checks

Although both terms involve rendering a check unusable in some way, the timing and purpose differ.

1. Timing

- Voided checks: Written before funds are transferred.

- Cancelled checks: Occur after a transaction clears the bank.

2. Purpose

- Voided checks: Supply banking information without risk of payment.

- Cancelled checks: Serve as a receipt or proof of payment.

3. Usage

- Voided checks: Set up financial services like direct deposits or auto-pay.

- Cancelled checks: Provide record-keeping and legal proof of completed transactions.

4. Appearance

- Voided checks: Marked with the word “VOID” across the front.

- Cancelled checks: Stamped, imaged, or flagged by the bank’s system as cleared.

Understanding these differences ensures that you provide the right type of check when requested by an employer, service provider, or institution.

Why Employers and Businesses Request Voided Checks

Employers often ask for voided checks when setting up payroll. The information printed on the check—routing number, account number, and bank—ensures funds are deposited into the correct account.

Financial institutions also request voided checks to verify account ownership. This adds an extra layer of accuracy when linking accounts for mortgages, investments, or utility payments.

Using a voided check eliminates errors that could occur if account numbers are mistyped during setup.

Digital Alternatives

With fewer people using paper checks today, digital solutions are becoming more popular. Online payroll systems may allow employees to upload account details directly. Banks also provide digital images of cancelled checks for record-keeping instead of mailing physical copies.

For situations where a voided check is required but no checkbook is available, an online voided check generator offers a convenient option. These tools create a digital version of a check containing the necessary account and routing information. Employers or financial institutions can then accept the generated version just like a traditional voided check.

Security Considerations

Whether dealing with voided or cancelled checks, protecting personal information is crucial. Checks display sensitive details that could be misused if they fall into the wrong hands.

Best practices include:

- Writing “VOID” in large, bold letters to ensure no one can alter the check.

- Providing voided checks only to trusted employers or institutions.

- Accessing cancelled checks through secure online banking portals.

- Shredding paper copies once they are no longer needed.

The Role of Cancelled Checks in Record-Keeping

Cancelled checks remain valuable for both personal and business records. They provide concrete evidence that payments were made and received. Many banks store digital copies for up to seven years, making them accessible during audits, legal disputes, or tax preparation.

Businesses, in particular, rely on cancelled checks to verify transactions during annual reporting. They help maintain accurate records and can protect against fraud or disputes.

Conclusion

Voided checks and cancelled checks serve distinct but equally important roles. A voided check supplies account information safely for setting up deposits or payments. A cancelled check confirms that money has been transferred successfully and provides proof of payment.

Understanding when to use each type prevents errors and ensures smoother financial transactions. And for those without access to traditional checkbooks, modern solutions like an online voided check generator make it easier than ever to provide the right documentation when needed.