What is Corporate Governance?

The phrase corporate governance combines the two words corporate and governance. Corporate is a word used to describe a business or company, whilst governance refers to the framework an institution, business, or other organization uses to operate. In this article, we will answer the question: What are the 4 pillars of corporate governance? First, we need to define what corporate governance is. In essence, corporate governance is a toolset for management, and the board to deal with company challenges more effectively. It outlines the procedures used to regulate firms and their goals and identifies who is in charge, who is responsible, and who takes decisions. It involves relationships among a company's leadership, its board of directors, shareholders, and other stakeholders, and it aims to ensure that the management of the business is moral, open, and responsible. It focuses on procedures and practices to ensure that a business is conducted to meet its goals and that stakeholders can feel confident that their trust in that business is well-founded.

Related: Corporate governance: Everything you need to know

Importance of corporate governance

An organization's board of directors must hold frequent meetings, maintain control over the company, and clearly define roles to practice good corporate governance. Additionally, a strong risk management system is ensured. One of the foundational elements of any successful company is corporate governance. Strong and efficient corporate governance structures, which encourage exceptional performance and a long-term profitable organization, foster a corporate integrity culture. It promotes accountability across all staff members and groups inside your organization, aiming to avert errors before they even happen. Strong corporate governance sends a message to the market that a business has responsible management and that management's interests are aligned with those of external stakeholders. It can therefore give your business a significant competitive advantage.

Related: How to Apply Corporate Governance to Organizations

What are the 4 pillars of Corporate governance?

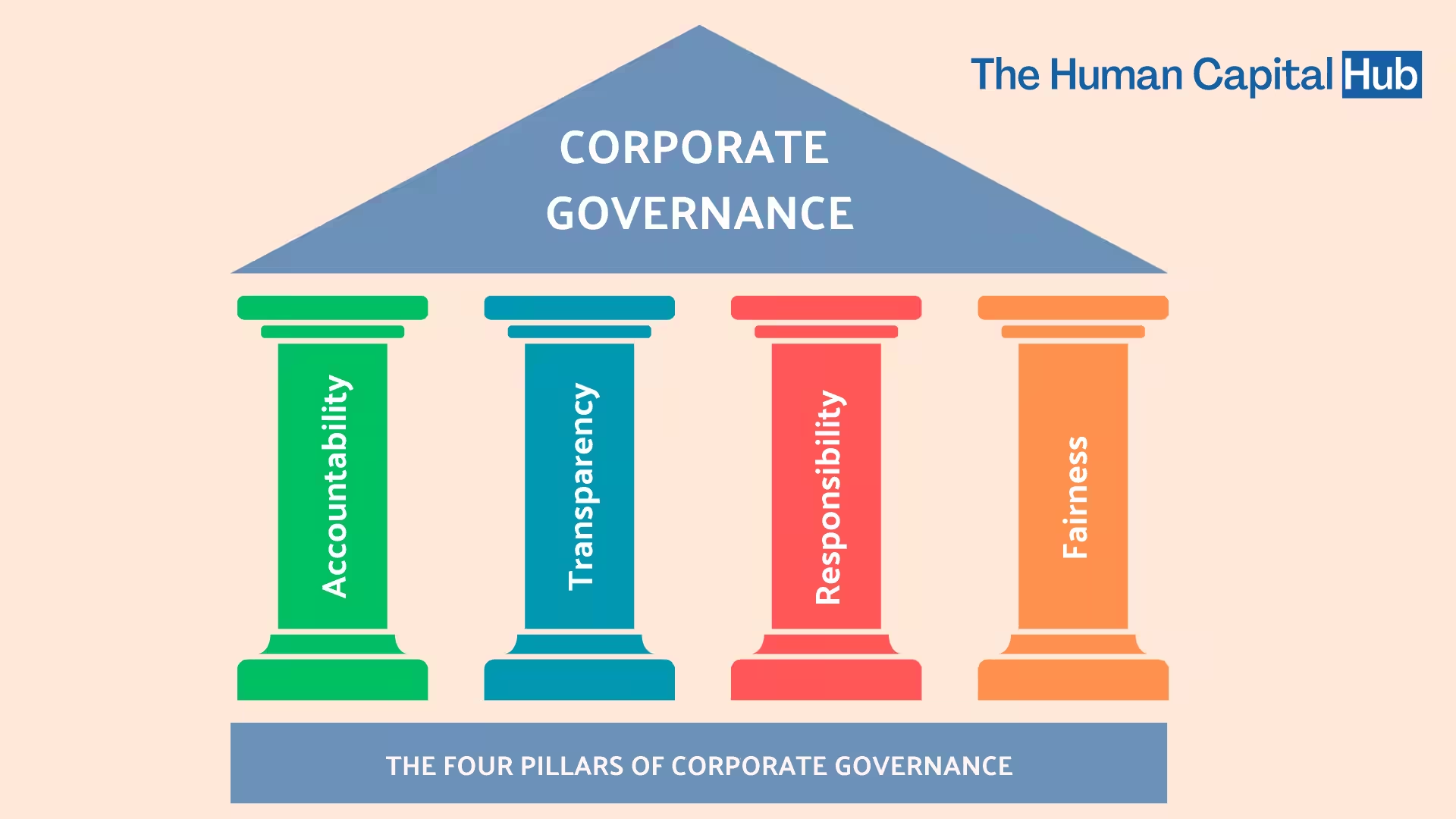

Now that we understand what corporate governance entails let's answer the question: What are the 4 pillars of corporate governance? There are four pillars for successful corporate governance: accountability, fairness, transparency, and responsibility.

Related: The Failure of Corporate Governance and Its Impact on Business

Pillar 1: Accountability

Accountability means being responsible or having to answer. Investors are interested in who will be responsible for each activity and accountable when something goes wrong. Even when everything goes as planned, shareholders' trust, which increases their desire to invest more, is boosted by the knowledge that someone will be held accountable for successes and failures in the future. This holds for everyone, from staff members to the top leadership, who embrace risk management with a formalized appetite for risk. This also includes cultivating a culture of compliance to generate a genuine and perceived belief that the entity is operating within internal and external boundaries.

Accountability is closely linked to transparency and involves holding company management and the board of directors responsible for their actions and decisions. This includes ensuring that they act in the company's and its shareholders' best interests and that they are held accountable for any breaches of laws, regulations, or ethical standards. An effective corporate governance framework includes mechanisms for reporting and addressing any misconduct, conflicts of interest, or unethical behavior by company officials and for taking appropriate actions to rectify any issues identified.

Related: 4 Tips to Hold Your Employees Accountable

The Importance of Accountability in Corporate Governance

Accountability is crucial to corporate governance as it ensures that companies are held responsible for their actions and decisions. It promotes transparency and integrity in business operations, fostering trust among stakeholders. Companies need to be accountable for their financial performance, adherence to laws and regulations, ethical conduct, and management of risks. When companies are transparent and accountable, they are more likely to gain the trust of investors, customers, employees, and other stakeholders, which can positively impact their reputation and long-term success.

Pillar 2: Transparency

Transparency is another crucial pillar of corporate governance, as it ensures that companies operate openly and transparently, with information accessible to stakeholders. Transparency involves disclosing information about the company's financial performance, business operations, risks, governance structure, and other relevant matters. This allows stakeholders to clearly understand the company's activities, performance, and decision-making processes. Transparency and accountability are the foundation of corporate governance. Transparency involves providing accurate and timely information about the company's financial performance, business operations, risks, and opportunities. This can be achieved through regular financial reporting, disclosure of material information, and clear communication channels between the company and its stakeholders.

A corporation must be open and willing to provide timely information on the company's financial, social, and political position to shareholders, stakeholders, customers, and the general public. A board demonstrates good corporate transparency with a functioning audit committee, routine external audits, and objective, accurate yearly reports.

The Importance of Transparency in Corporate Governance

Companies that are transparent in their operations and decision-making processes build trust with their stakeholders, including shareholders, employees, customers, and the wider public. Corporate governance must include transparency since it makes sure that any action taken by a firm may be reviewed at any moment by a third party. This verifies its transactions and processes, enabling the organization to respond to inquiries regarding specific steps if they arise.

Pillar 3: Fairness

Fairness is a crucial tenet of corporate governance because it guarantees that businesses treat all their stakeholders fairly and equally, including shareholders, employees, clients, suppliers, and communities. Businesses should develop guidelines and procedures that encourage equity and guard against prejudice, bigotry, and unjust treatment. This involves ensuring that every shareholder, regardless of their share count or influence, has an equal opportunity to participate in the company's decision-making procedures, such as casting a vote on crucial issues and electing directors. To protect the interests of all stakeholders, fairness also entails putting in place efficient mechanisms for risk management, internal controls, and audit procedures. To ensure that executive compensation, performance reviews, and board nominations are merit-based, businesses should implement fair and transparent systems.

Related: 11 Reasons Why Workplace Fairness Matters for Every Employer

The Importance of Fairness in Corporate Governance

Fairness makes the workplace run more smoothly in several ways. It assists the business in gaining the confidence of society and local and state authorities. Management and employee will be confident and positive about the organization. Stakeholders frequently participate and accept greater responsibility for their activities.

Pillar 4: Responsibility

The last pillar in answering the question: What are the 4 pillars of corporate governance is responsibility? Responsibility focuses on businesses acting in a socially and ecologically responsible way. Businesses should consider how their decisions affect society, the environment, and future generations. This entails implementing ethical and sustainable corporate practices, such as minimizing environmental effects, fostering diversity and inclusion, upholding human rights, and enhancing community well-being. Responsibility also entails interacting with stakeholders and responding to their issues and demands. Companies should set up efficient communication channels with their stakeholders; these include routine shareholder meetings and soliciting stakeholder feedback and input to guide their decision-making. Companies should also be transparent about their social and environmental performance and progress toward sustainability goals and be willing to be held accountable for their actions. This pillar also entails an organization carrying out corporate social responsibility, which yields enhanced community support, branding, and customer loyalty.

Related: What is Corporate Governance?

The Importance of Responsibility in Corporate Governance

Businesses can boost consumer loyalty and retention by implementing social responsibility activities. Companies that practice social responsibility have the chance to differentiate themselves from the competition because they develop a strong and favorable brand reputation.

Related: Corporate Governance and Business Financial Performance

Conclusion

In this article, we have answered the question: What are the 4 pillars of corporate governance? Accountability, transparency, fairness, and responsibility are essential for building strong corporate governance practices within organizations. These pillars ensure that companies are held responsible for their actions, operate openly and transparently, treat all stakeholders fairly, and act responsibly towards society and the environment. Companies prioritizing these pillars are more likely to gain the trust and confidence of their stakeholders, which can lead to long-term sustainability and success. Companies must integrate these pillars into their governance framework and adopt best practices to foster effective and ethical corporate governance. By doing so, companies can create value for their shareholders and society at large.

Frequently Asked Questions

1. What are the four pillars of corporate governance?

Transparency: This pillar emphasizes the importance of openness and disclosure in corporate practices. It involves providing accurate and timely information to stakeholders, including shareholders, employees, customers, and the public. Transparent corporate governance ensures that all relevant information is available to stakeholders, enabling them to make informed decisions.

Accountability: Accountability refers to the responsibility of individuals and organizations for their actions and decisions. In corporate governance, directors, executives, and other key stakeholders are accountable for their decisions and actions that impact the company's performance and interests. This includes ensuring compliance with laws and regulations, ethical standards, and fulfilling fiduciary duties.

Fairness: Fairness in corporate governance means treating all stakeholders fairly and equitably. It involves avoiding conflicts of interest, ensuring equal treatment of shareholders, protecting minority shareholders' rights, and promoting fairness in decision-making processes. Fair corporate governance fosters trust among stakeholders and contributes to long-term sustainability.

Responsibility: Responsibility refers to the duty of directors and executives to act in the best interests of the company and its stakeholders. It involves making decisions that consider short-term financial gains, long-term sustainability, and social impact. Responsible corporate governance encompasses environmental stewardship, social responsibility, and ethical business practices.

These four pillars provide a framework for effective corporate governance by promoting transparency, accountability, fairness, and responsibility in organizational practices. By adhering to these principles, companies can enhance stakeholder trust, mitigate risks, and achieve sustainable growth.

2. What is the most important pillar of corporate governance?

Research shows that there are multiple important pillars of corporate governance, and there is no clear consensus on which is the most important. Stănculescu 2015 discusses the three fundamental pillars of corporate governance: shareholders, board of directors, and employees. Tenuta 2020 notes that the board of directors is a major intersection point for many corporate governance issues. Mulyadi 2012 emphasizes the importance of corporate governance in the public sector, focusing on performance and conformance aspects. Vukčević 2012 argues that corporate governance is important for creating an environment conducive to investments and competition, encouraging development and productivity, and limiting the abuse of authority. Overall, the papers suggest that corporate governance is a complex system with multiple important pillars, and the relative importance of each pillar may depend on the specific context.

3. What are the main purposes of corporate governance?

Research suggests that corporate governance's main purpose is to promote fairness, transparency, and economic efficiency while reconciling conflicts of interest between various corporate claim holders. Mohamad (2011) argues that good corporate governance practices facilitate economic efficiency by focusing on value-enhancing activities and efficient allocation of resources. Becht (2003, 2002) reviews the theoretical and empirical research on the main corporate control mechanisms and discusses the main legal and regulatory institutions in different countries. Ricart (2022) explores the development of purpose in corporate governance and the challenges faced, analyzing the theme at the intersection between stakeholder theory and business models. Overall, the papers suggest that corporate governance is concerned with promoting the interests of various stakeholders while balancing the trade-offs between purpose and profit.

The main purposes of corporate governance can be summarized as:

Protecting shareholders' interests: Corporate governance ensures that the rights and interests of shareholders are safeguarded. It aims to prevent any abuse of power by management and promotes transparency in decision-making processes.

Enhancing accountability: Good corporate governance establishes clear lines of responsibility and accountability within an organization. It ensures management is accountable to shareholders and other stakeholders for their actions and decisions.

Promoting ethical behavior: Corporate governance sets standards for ethical conduct within a company. It encourages transparency, integrity, and fairness in business operations, helping build stakeholder trust.

Mitigating risk: Effective corporate governance helps identify and manage company risks. It establishes risk assessment, monitoring, and control mechanisms to minimize potential losses.

Attracting investment: Companies with strong corporate governance practices are more likely to attract investment from shareholders and other stakeholders. Investors value transparency, accountability, and sound decision-making processes when considering where to invest their capital.

Improving performance: Good corporate governance improves operational efficiency and financial performance. It promotes effective decision-making, strategic planning, and risk management practices that can enhance a company's overall performance.

Ensuring compliance: Corporate governance ensures compliance with applicable laws, regulations, and industry standards. It helps companies avoid legal disputes, penalties, reputational damage, and other adverse consequences of non-compliance.

4. What are the keys to successful corporate governance?

The research papers cited below suggest that successful corporate governance is based on principles that promote fairness, transparency, and accountability. Iskander (2000) emphasizes that there is no single, universally applicable corporate governance model and that governance initiatives are most effective when driven from the bottom up. Epstein (2004) notes that regulators have established new governance requirements that have significant implications for boards of directors, senior managers, and financial and accounting professionals. Mohamad (2011) argues that good corporate governance practices facilitate economic efficiency by focusing on value-enhancing activities and efficient allocation of resources. Finally, the OECD Principles of Corporate Governance (Económicos, 2005) highlight the importance of good corporate governance in underpinning market confidence, financial market integrity, and economic efficiency.

In Vietnam, numerous companies have made significant strides in enhancing their corporate governance practices through the assistance of the International Finance Corporation (IFC). These companies have reported a wide range of benefits from improved governance, including increased profitability, enhanced reputation, improved access to finance, and reduced risks. The IFC's support has facilitated these positive outcomes for Vietnamese businesses.

In the Middle East and North Africa (MENA) region, 19 companies from various sectors recently shared their remarkable corporate governance success stories with the World Bank Group. These companies have implemented a range of transformative changes, including adopting comprehensive codes of conduct, enhancing board composition and performance, increasing transparency through improved information disclosure, and prioritizing the protection of minority shareholders.

5. What are the factors that influence corporate governance?

Research papers suggest several factors influence corporate governance. Baysinger (1985) argues that board size, composition, structure, directors' compensation, and frequency of board meetings are important factors. Becht (2002) cites different countries' legal and regulatory institutions as contributors to corporate governance. Khan (2011) emphasizes balancing stakeholders' interests and reducing agency problems through effective corporate governance. Heinrich (2007) identifies four factors influencing corporate governance performance in post-socialist companies: pressure from majority and minority shareholders, internationalization/globalization, and state regulation. Overall, the papers suggest that corporate governance is a complex issue influenced by various factors, including board composition, legal and regulatory institutions, stakeholder interests, and external pressures.

According to a McKinsey global survey on governance, board directors today exhibit increased confidence in their understanding of the companies they serve and demonstrate a more strategic approach compared to 2011. The survey reveals that board members now allocate more time towards strategic matters while reducing their time to M&A activities. This shift highlights board directors' evolving priorities and focus in contemporary business environments.

A McKinsey article on organization and governance notes that aligning the organization and governance with a business or corporate function's strategy and value proposition is identified as a key lever for enhancing effectiveness and efficiency. This entails clarifying roles and responsibilities, optimizing spans of control, streamlining decision-making processes, and fostering collaboration. By aligning these elements, organizations can better leverage their resources and capabilities to achieve their strategic objectives and deliver value to stakeholders.

6. What are the major challenges faced in corporate governance?

Here are some of the key challenges faced in corporate governance:

1. Board Composition and Independence: One of the primary challenges is ensuring a diverse and independent board of directors. It is important to have directors with varied backgrounds, skills, and experiences who can provide objective oversight and strategic guidance. However, finding qualified individuals willing to serve on boards can be challenging, especially for smaller companies or those operating in niche industries.

2. Executive Compensation: Another challenge is designing executive compensation packages that align with long-term shareholder interests while attracting and retaining top talent. Balancing performance-based incentives with risk management considerations can be complex, as excessive executive pay or misaligned incentives can lead to unethical behavior or short-term decision-making.

3. Shareholder Activism: Shareholder activism has increased recently, with investors demanding greater transparency, accountability, and responsiveness from companies. This challenges corporate boards to effectively engage with shareholders and address their concerns while focusing on long-term value creation.

4. Risk Management: Effective risk management is crucial for corporate governance. Companies need to identify and mitigate risks related to cybersecurity, compliance with regulations, reputational damage, and environmental sustainability. However, staying ahead of emerging risks and implementing robust risk management frameworks can be challenging in a rapidly changing business environment.

5. Ethical Conduct: Maintaining high ethical standards is vital for effective corporate governance. Ensuring compliance with laws and regulations, preventing conflicts of interest, and promoting a culture of integrity can be challenging when dealing with complex business operations, global supply chains, and diverse stakeholder interests.

6. Stakeholder Engagement: Engaging with various stakeholders, including employees, customers, suppliers, communities, and investors, is a key aspect of corporate governance. However, balancing the interests of different stakeholders and effectively communicating with them can be challenging, especially when their expectations and priorities differ.

7. International Compliance: Complying with diverse legal and regulatory frameworks can significantly challenge multinational companies operating in multiple jurisdictions. Companies must navigate complex international laws, cultural differences, and varying corporate governance practices while maintaining consistency in their operations and reporting.