What is a salary survey?

A salary survey is a tool used to determine the compensation paid to employees in one or more jobs. Compensation data, collected from several employers, is analysed to develop an understanding of the amount of compensation paid for each job position. Salary surveys may focus on one or more job titles, employer size, and or industries. Some define a salary survey as a process by which internal jobs are matched to external jobs with similar responsibilities to identify the market rate for each position.

Why salary surveys?

Employee engagement has an important relationship to salary and one that shouldn’t be taken lightly. For many employees, justifying their current salary is important to understand the company they work for. If an employee finds themselves feeling underpaid in comparison to their peers, this could result in them harboring negative feelings towards their employer which, when not addressed can lead to more serious issues surrounding job dissatisfaction. Failure to remunerate employees comparably to similar roles outside the organisation can result in failure to attract key talent. Therefore, your organisation must ensure that its salaries are comparable to or better than what competitors are paying.

Related: Salary Surveys: Everything you need to Know About

Types of salary surveys

There are two types of salary surveys, generic surveys and customised surveys. Generic surveys can be described as off-the-shelf surveys presented in generic job titles and job grades which apply across the board. Customised salary surveys, as the name suggests, are conducted by a remuneration expert with specific terms of reference written by the client.

There are pros and cons to each of the survey types. Generic surveys are readily available. This means that for a quick board meeting, you can easily request one and get the salary information you require. However, generic surveys may include companies which may not be comparable to yours. As such, the reliability and relevance and value of such a survey are questionable. Customised salary surveys, on the other hand, are very specific to your organisation. This type of survey allows your company to select comparator organisations. This could be based on sector, and organisation size in terms of both revenue and headcount.

The output of such is survey is how your salaries are faring when compared to the comparator organisations of your choice. Furthermore, you can quantify the risk of losing your employees and how much it will cost your organisation if you are to match the salaries, which your competitors are paying. However, customised salary surveys take time and you do not have any guarantee that your chosen comparator organisations will participate in the survey.

Related: Salary Surveys and salary survey participation

Salary survey results need to be interpreted carefully. Some jobs are restricted to one industry while others, especially those in support functions such as Marketing, Human Resources, and Administration are found across many sectors. For positions specific to one industry, you should benchmark salaries within your industry but for those that are found across many sectors, it is prudent that you benchmark against a sample that includes several sectors.

Advertisment

For each job title, make sure that it has been benchmarked against at least five other similar positions. The sample size of five here is given as a rule of thumb. For positions where there are a lot of incumbents e.g. miners, a relatively larger sample size is required.

If the sample is constituted with good comparator organisations and if it is of the right size, the next step is interpreting the salary survey results. The average is sensitive to outliers. This means that a single organisation that pays extremely high or extremely low salaries will distort the results of the survey and mislead your decision-making process. This is where percentiles come in. They take care of outliers.

Many organisations choose as their pay policy lines, the market 25th percentile (lower quartile), market 50th percentile (median) and the market 75th percentile (upper quartile). For example, an organisation paying salaries that are at the market 75th percentile means it is paying salaries that are better than 75% of what other organisations are paying. If you are paying an Accountant a salary that is at the 75th percentile it means for that accountant position you are paying better than 75% of the market participants.. It is also important to look at the coefficient of variation when interpreting salary survey results.

The Coefficient of Variation (CV) is a measure of the relative variation of data values about the mean in terms of percent. CV= Standard Deviation/Mean. The smaller the CV the less relative variation there is of the data points about the mean. The larger the CV, the larger the relative variation there is of the data points about the mean. If it is a customised salary survey report, it is very important to look at the compa-ratio. A compa-ratio analysis indicates how competitive your salaries are relative to market rates.

A compa-ratio of 100% indicates that the individual is paid at the market rate. A compa-ratio above 100% shows that the individual concerned is paid above the target market. A compa – ratio of 125% implies that you pay your employee 25% above the market rate. The ideal compa-ratio ranges from 80% to 120%. For a customised salary survey, it is also important to look for flight risk analysis results. The flight risk analysis takes into consideration the compa – ratio i.e. the amount paid to an employee relative to the amounts paid to other employees as their total cost of employment.

Where an employee earns a salary that is less than 80% of the market median of similar roles i.e. compa – ratio less than 80%, the chances of getting a better salary offer are high. If the compa–ratio is between 80% and 120%, the chances of getting a better salary offer are moderate. Where the compa–ratio is above 120%, the chances of getting a better salary offer are low. These chances are then used to determine flight risk.

Related: Check out the compa-ratio calculator

Usually, salary results are reported in three parts which are basic salary, total monthly direct cash and total cost of employment. The basic salary covers just the basic salary excluding all allowances. The total monthly direct cash which covers the base salary plus all monthly cash allowances. The total cost of employment covers the full employment costs.

For organisations not on the Total Cost to Company Model where all employee benefits are lumped up into one cash amount for each employee, one needs to know how much they should give their employees as allowance. The questions to ask are as follows: How many organisations provide this allowance? Does the amount give as the allowance increase as you move from non-managers to managerial levels? Is this allowance given as a necessity for work? If the allowance includes dependents or beneficiaries, how many are included and to what extent are they included? If the allowance or benefit is a non-cash allowance (e.g. company vehicle), what is the value attached to that benefit?

Related: The benefits and risks that you need to know about surveys

If a company misinterpret salary survey data and end up awarding salary adjustments without fully understanding the data or the consequences it can lead to the organisation not being able to sustain the wage bill.

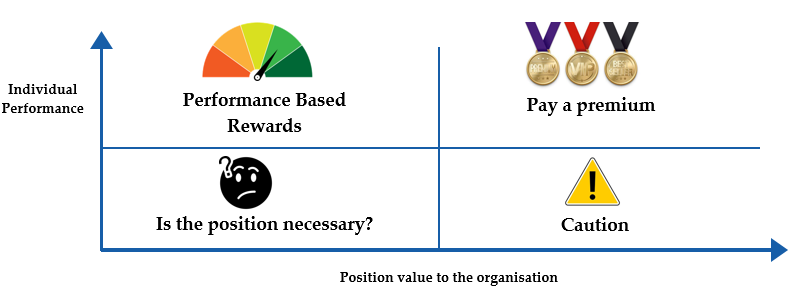

In conclusion, when making decisions on how much to pay an individual it is important to take note of the individual’s performance and position value to the organisation.

Taurai Masunda is a Business Analytics Consultant at Industrial Psychology Consultants (Pvt) Ltd a management and human resources consulting firm. https://www.linkedin.com/in/taurai-masunda-b3726110b/ Phone +263 4 481946-48/481950/2900276/2900966 or email: taurai@ipcconsultants.com or visit our website at www.ipcconsultants.com